Homeowners Insurance in and around Chesapeake

Chesapeake, make sure your house has a strong foundation with coverage from State Farm.

Help cover your home

Would you like to create a personalized homeowners quote?

Welcome Home, With State Farm Insurance

None of us can see what we will encounter in the future. That’s why it makes good sense to plan for the unexpected with a State Farm homeowners policy. Home insurance protects more than just your home's structure. It protects both your home and your precious belongings. In the event of vandalism or a fire, you could have damage to some of your belongings in addition to damage to the structure itself. Without insurance to cover your possessions, you won't get any money to replace your things. Some of your valuables can be covered if they are lost or damaged outside of your home, like if your car is stolen with your computer inside it or your bicycle is stolen from work.

Chesapeake, make sure your house has a strong foundation with coverage from State Farm.

Help cover your home

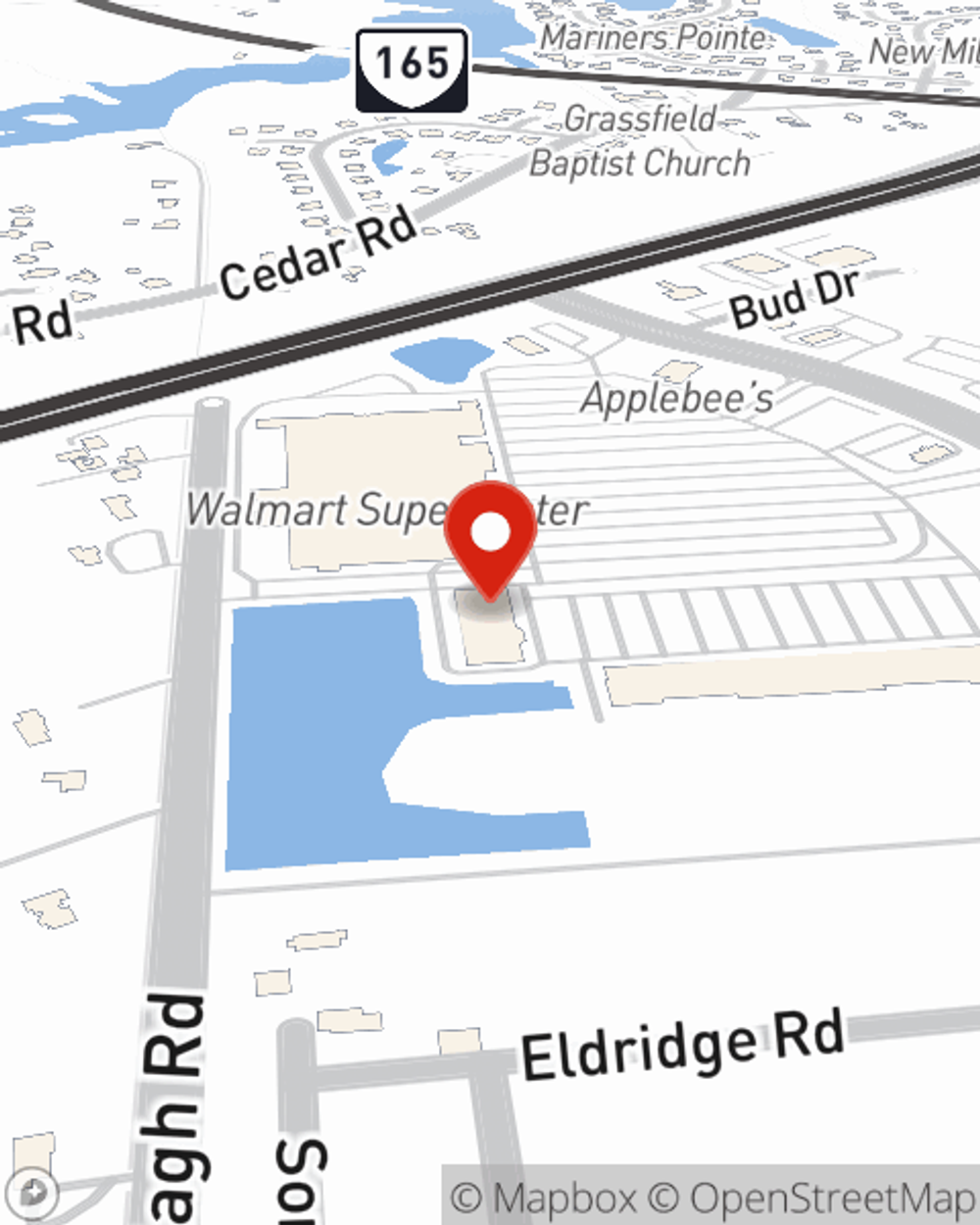

Agent Zack Keaton, At Your Service

State Farm Agent Zack Keaton is ready to help you navigate life’s troubles with dependable coverage for your home insurance needs. Such personalized service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If the unexpected happens, Zack Keaton can help you submit your claim. Find your home sweet home with State Farm!

As your good neighbor, State Farm agent Zack Keaton is happy to help you with exploring your specific homeowners coverage options. Reach out today!

Have More Questions About Homeowners Insurance?

Call Zack at (757) 389-5775 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Roof maintenance tips for your home

Roof maintenance tips for your home

Your roof is put to the test daily. Learn how to recognize the first signs of a problem inside or outside your home and when to get a new roof.

Zack Keaton

State Farm® Insurance AgentSimple Insights®

Roof maintenance tips for your home

Roof maintenance tips for your home

Your roof is put to the test daily. Learn how to recognize the first signs of a problem inside or outside your home and when to get a new roof.